When you're at fault in a mishap, problems to your car can be covered by accident coverage. Damages to one more car when you're at fault https://canvas.instructure.com/eportfolios/153055/carinsurancedeductibleyqlp707/Florida_Insurance_Requirements__Florida_Department_Of__Can_Be_Fun_For_Everyone can be covered by residential property damage obligation insurance policy. Whether or not you're at mistake in a mishap, your rates may rise due to a new claim on your data.

Spoken threshold: States can define the seriousness of a mishap, and based on that, allow claims. As an example, a state may establish that the spoken limit is death or disfigurementif either occurs in an accident, you might be able to file a claim against. How to pick the appropriate insurance coverage in a no-fault state: There are a couple of things to think about when building your insurance coverage in a no-fault state.

Considering the financial concern you would certainly take on in an accident is a good start. Mentioning locating the right coverage, do not neglect to compare quotes when purchasing a brand-new vehicle insurance plan. The only method to make certain you obtain the very best price and also protection for you is to contrast individualized quotes.

About What Is No-fault Car Insurance? - Nolo

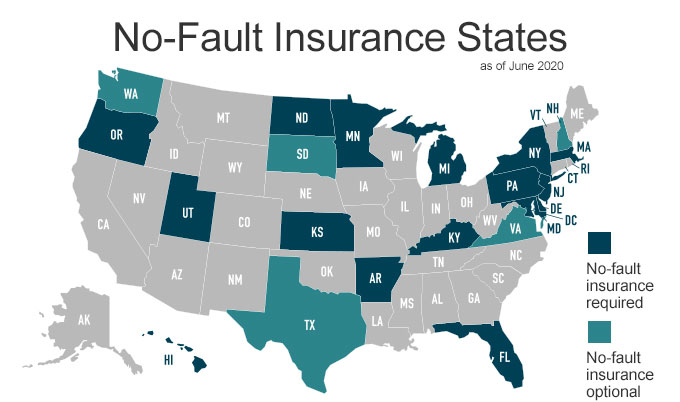

It can pay for medical bills, shed salaries, kid treatment as well as even more, depending on where you live. No-fault insurance is called for in 12 states, while a couple of various other states permit you to include it as an optional add-on, or forgo it entirely.

Depending on the state, no-fault insurance may additionally cover: if you are not able to function due to the injury., such as a housecleaning or child care. if an injury results in death., or a small fatality benefit, if the mishap results in your death and you leave making it through dependents.

The states that need no-fault insurance policy have different minimum needs. Use the table listed below to see what the minimal no-fault insurance coverage demands are for your state.

4 Simple Techniques For What Is No-fault Insurance And How Does It Work ...

Up to $50,000 in insurance coverage if you are enlisted in Medicaid and another participant of your home has insurance policy that will certainly cover injuries from an automobile crash. Choose out of PIP clinical protection if you have Medicare as well as another member of your family has a car insurance policy or wellness insurance policy that pays for injuries from vehicle crashes.

Nevertheless, no-fault insurance policy is wonderful to have when a car mishap occurs because you don't have to go out of your means to add the coverage. Minimum Car Insurance Policy Demands in Minnesota, Like any state, Minnesota requires minimums for their insurance plan. This means that when you purchase car insurance policy, you're called for to obtain the minimum quantities listed here.

$60,000 if greater than one person is hurt)$10,000 responsibility insurance coverage per mishap for property damages$25,000 in without insurance driver coverage, each for injuries ($50,000 if greater than a single person is wounded)If you are in charge of the accident, and also the prices surpass the limitations stated above, you may be held liable for the remainder of the payment.

The Faq: What Does No-fault Mean? - Sand Law, Llc Diaries

You do not have to worry about the insurance policy company rejecting your claim due to the fact that of a conflict in regards to the auto crash.